do nonprofits pay taxes on rental income

Do nonprofits pay payroll taxes. As such if you managed to generate 20000 in net rental income and you belong to the 22.

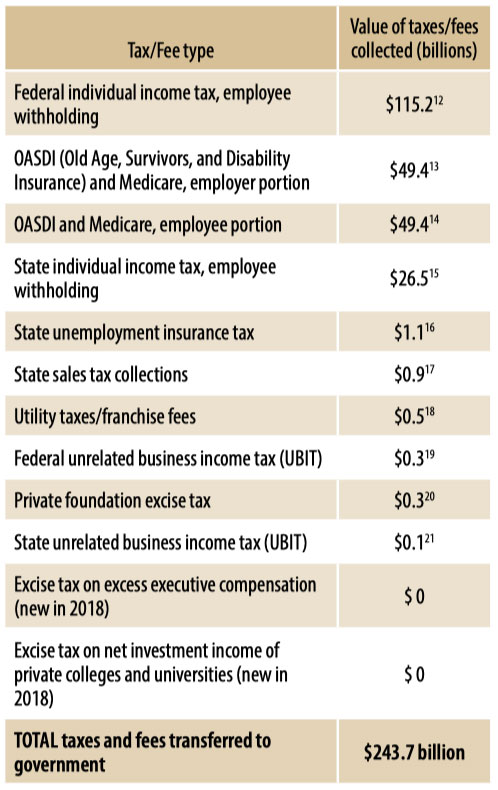

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

Any rental income you received as a property owner is taxable and should be reported.

. Non-profit organizations are not exempt from paying all taxes. You need to pay tax on rental income in the year its earned. Any net rental income you earn is taxable on the same level as your ordinary income.

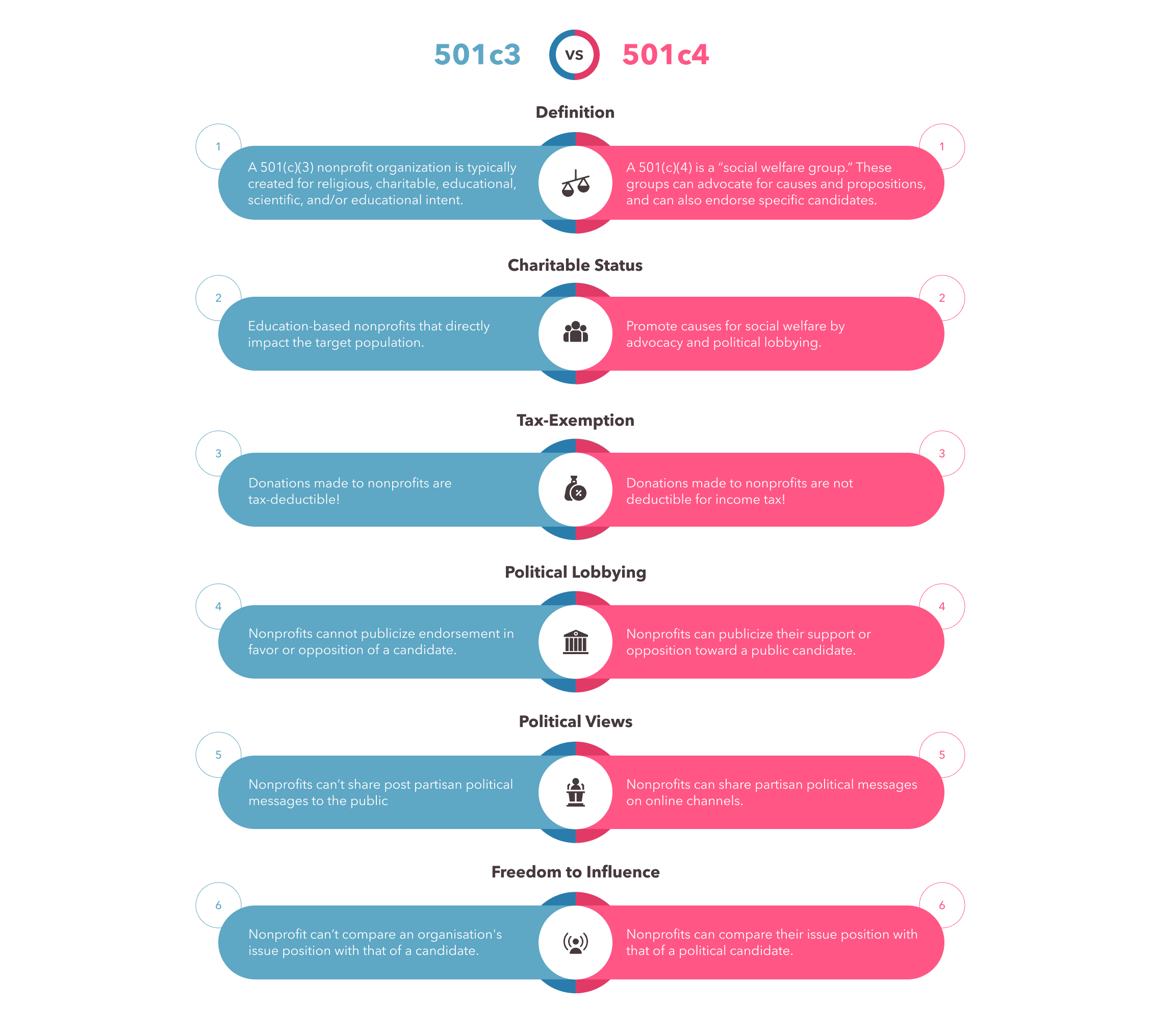

Frequently nonprofits have revenue that the IRS considers unrelated to their tax-exempt purpose and it is that income that is taxable. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain. Your recognition as a 501c3 organization exempts you from federal income tax.

Do nonprofits pay taxes. People often believe that nonprofits are automatically tax-exempt but this is not the case. Rental income is any payment you receive for the use or occupation of property.

There are some other forms of. If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax. Report rental income on your return for the year you.

Its also important to understand your obligations for. Nonprofits engage in public or private interests without a goal of. Donations are tax-deductible for donors.

Contact HMRC if your income from property rental is between 1000 and 2500 a year. According to the IRS Unrelated Business. GST if youre renting out short-term rental property excess deductions.

Well not always. The first 1000 of your income from property rental is tax-free. State tax exempt benefits vary by state but most include.

If you earn other. While most US. Nonprofits are exempt from federal income taxes based on IRS subsection 501c.

As a general rule rental income can include rent payments security deposits leasing fees and any. The IRS reports that organizations that hire employees must pay payroll and other taxes on their team members. While it is true that under most circumstances tax-exempt organizations are not subject to a corporate level income tax as their taxable entity.

In addition to amounts you receive as normal. This is your property allowance. This means youll need to report that months rent as income when you file your taxes.

When the IRS reclassifies rentals as not-for-profits the rental income and. With over 30 types of nonprofits it can be difficult to determine which nonprofits fall into. You must report rental income for all your properties.

Some nonprofits are tax exempt meaning they do not have to pay federal corporate income tax. If you rent out property youll usually have to pay tax on the profit you make but how much you pay depends on which tax band your total income falls into. In the eyes of the IRS you have still received a months rent.

Yes nonprofits must pay federal and state payroll taxes.

How The Irs Defines Charitable Purpose Foundation Group

University Neighborhood Housing Program

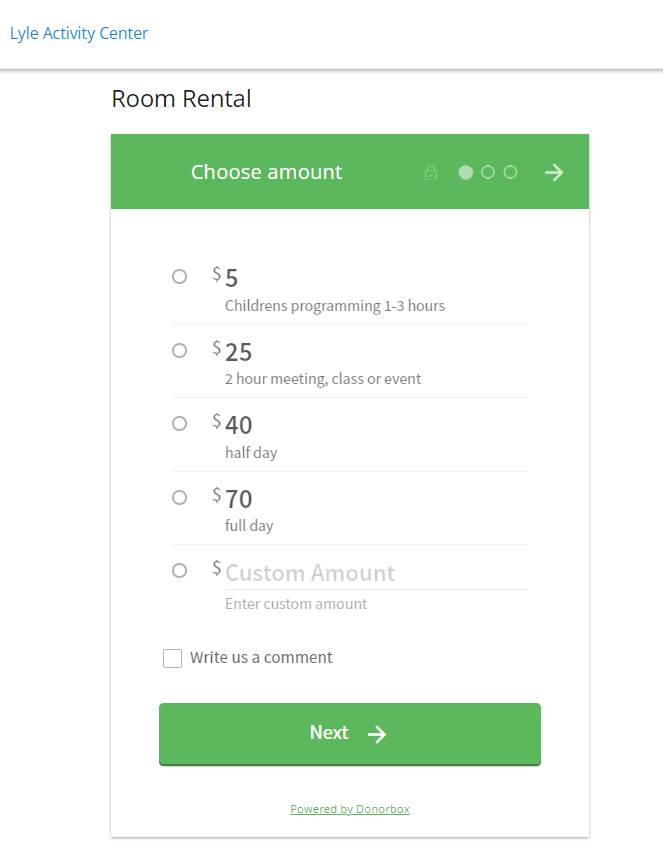

How Can A 501 C 3 Rent Property

How The Irs Defines Charitable Purpose Foundation Group

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

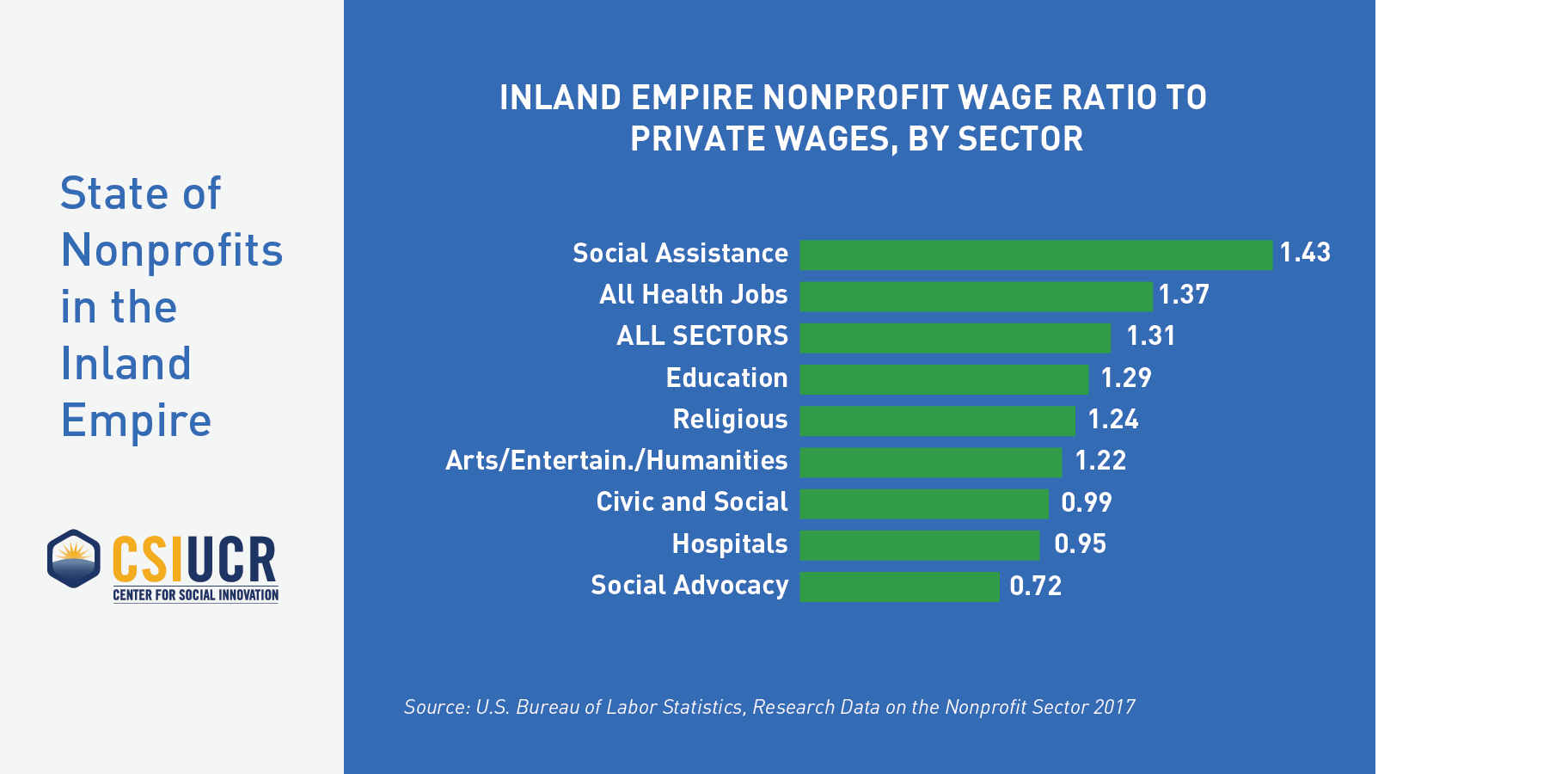

State Of Nonprofits In The Inland Empire Center For Social Innovation

Charitable Contributions You Think You Can Claim But Can T Turbotax Tax Tips Videos

Irs Form 990 Filing Instructions And Requirements For Nonprofits

Applying For The California Property Tax Welfare Exemption An Overview Nonprofit Law Blog

Foundations Of Unrelated Business Income For Religious Organizations Ppt Download

Nonprofits And The New Omb Uniform Guidance Know Your Rights And How To Protect Them National Council Of Nonprofits

Is Rental Income Taxable For A Nonprofit

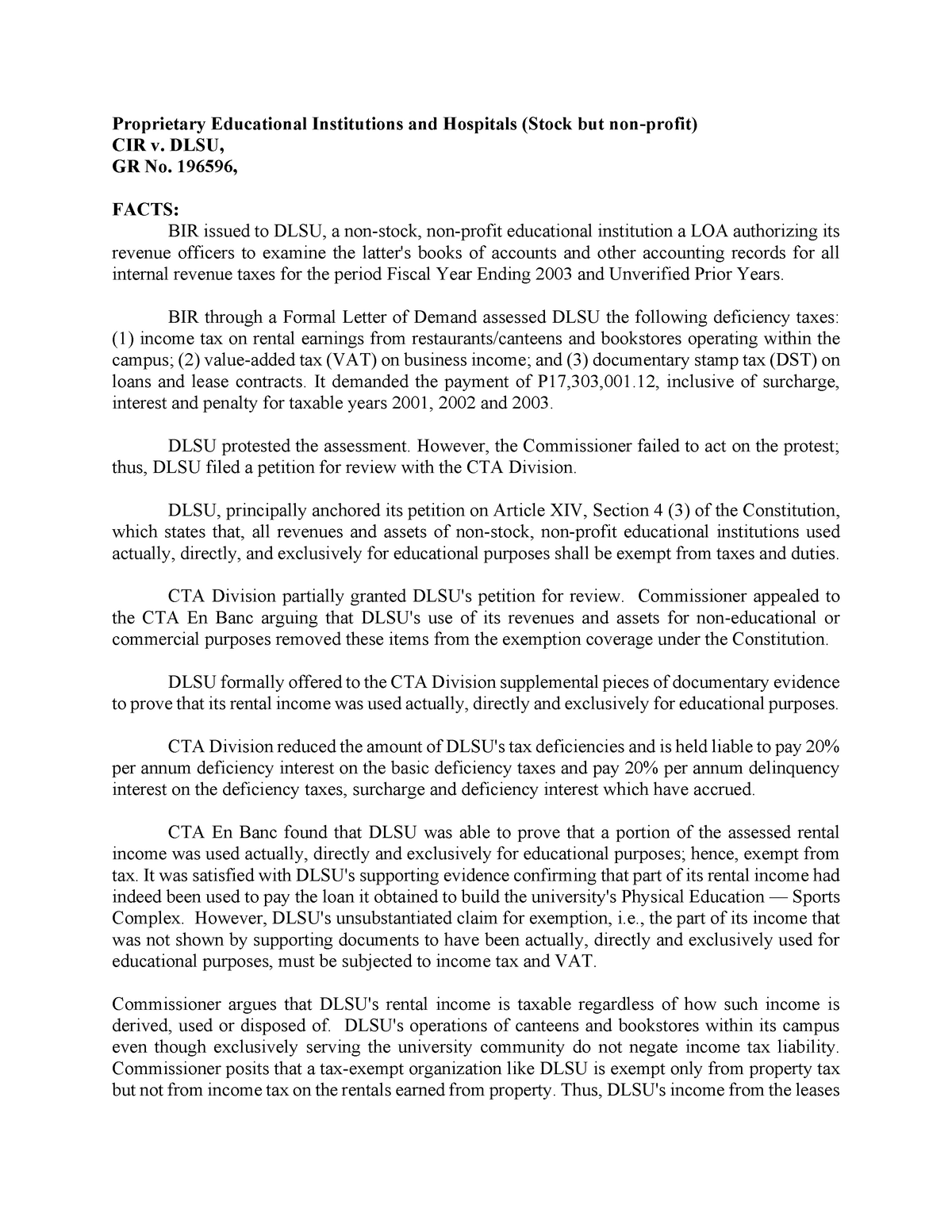

2 Cir V Dlsu Taxation I Case Digest Proprietary Educational Institutions And Hospitals Stock Studocu

Tax Information Nonprofits Renting Extra Space Church Facility Solutions

Do Arizona Nonprofit Organizations Pay And Or Collect Sales Taxes Asu Lodestar Center For Philanthropy And Nonprofit Innovation

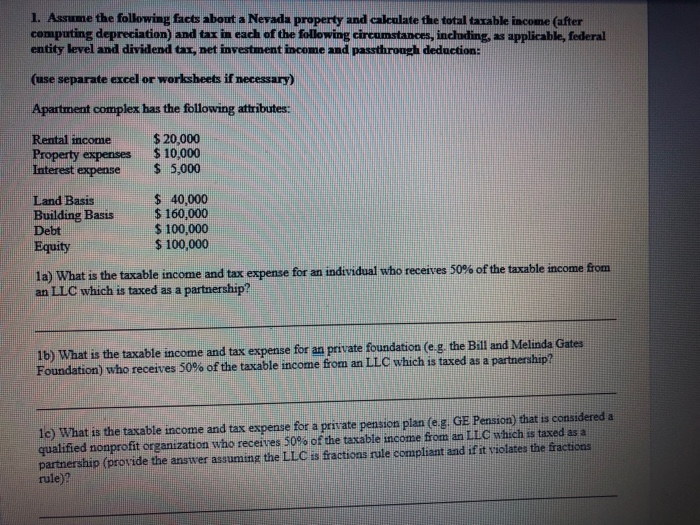

1 Assume The Following Facts About A Nevada Property Chegg Com